Payday Loans eLoanWarehouse: Understanding the Risks and Rewards

Payday loans eLoanWarehouse provide a quick financial solution for individuals facing unexpected expenses. Designed to offer fast cash, these loans typically allow borrowers to access funds ranging from $100 to $3,000, often deposited into their accounts within one business day. However, before opting for a payday loan from eLoanWarehouse, it’s essential to understand the associated terms, interest rates, and repayment conditions to ensure that this option aligns with your financial needs and capabilities.

In today’s fast-paced world, financial emergencies can arise unexpectedly, prompting many to seek quick solutions like payday loans. One such provider is eLoanWarehouse, which promises rapid access to cash. However, before diving in, it’s crucial to understand the implications of borrowing from this lender.

What is eLoanWarehouse?

eLoanWarehouse is an online platform that offers payday loans, allowing borrowers to access funds quickly—often within minutes. The application process is straightforward and conducted entirely online, making it convenient for those in urgent need of cash. Borrowers can typically secure loans ranging from $100 to $3,000 with repayment terms that may extend up to 12 months.

Key Features Of Payday loans eLoanWarehouse

• Fast Approval: Most applications receive an instant decision, and funds can be deposited into your account within 15 minutes of approval.

• No Hard Credit Checks: eLoanWarehouse primarily uses soft credit checks, which means your credit score remains unaffected.

• Flexible Loan Amounts: Depending on your income and borrowing history, you can access varying amounts.

The Price of Convenience: Pros and Cons of Payday loans eLoanWarehouse

While the allure of quick cash is appealing, it’s essential to weigh the pros against the cons.

Pros

• Quick Access to Funds: Ideal for emergencies where time is of the essence.

• Online Convenience: The entire process can be completed from home without lengthy paperwork.

Cons

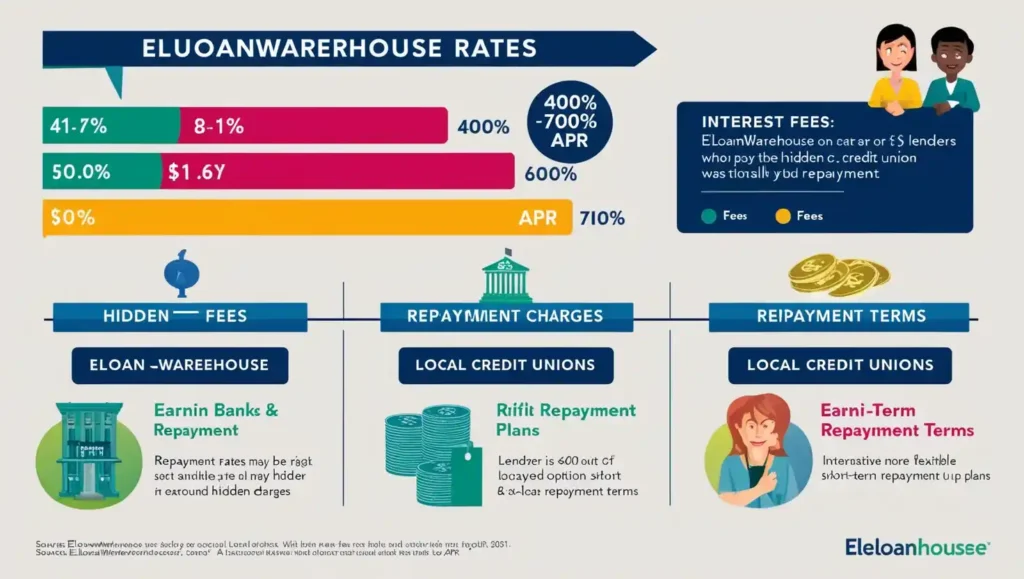

1. High Interest Rates: eLoanWarehouse’s interest rates can soar as high as 400% to 700% APR, significantly higher than traditional loans.

2. Hidden Fees: Borrowers often report unexpected fees that can exacerbate the total cost of borrowing.

3. Debt Cycle Risk: Many borrowers find themselves trapped in a cycle of debt due to rolling over loans or failing to meet repayment deadlines.

Should You Apply for a Loan from eLoanWarehouse?

Deciding whether to apply for a loan from eLoanWarehouse should depend on your financial situation and ability to repay. However, if you have poor credit and need immediate cash, this might seem like a viable option. However, be cautious of the associated costs and potential for falling into a debt trap.

Responsible Borrowing Tips

1. Only borrow what you absolutely need.

2. Read all terms carefully before signing.

3. Have a clear repayment plan in place.

Alternatives to eLoanWarehouse Payday Loans

If you’re hesitant about the risks associated with payday loans from eLoanWarehouse, consider these alternatives:

1. Credit Unions: Often provide lower interest rates and more flexible terms than payday lenders.

2. Personal Loans from Banks: Traditional banks may offer personal loans with better rates and terms.

3. Apps like Earnin or Dave: These platforms allow you to access earned wages without high fees or interest rates

Real Customer Testimonials

Customer experiences with eLoanWarehouse offer a mixed bag of feedback, highlighting both positive aspects and significant concerns. Here are some specific testimonials that illustrate the range of borrower experiences:

• Positive Experiences:

1. One customer praised the application process as “simple” and appreciated the clarity when additional information was needed, stating, “I never felt like I was being strung along” .

2. Another borrower highlighted the speed of service, noting, “I was very satisfied… the process was very fast… literally only 10 minutes” to get approved and receive funds .

3. A reviewer expressed gratitude for the helpful customer service, saying, “The loan officer was very knowledgeable and helpful… I’ll be doing business with you all moving forward” .

• Negative Experiences:

• Conversely, some customers reported troubling issues. One individual claimed they were charged twice for their loan repayment, totaling over $4,000, which led to frustration and confusion .

• Another customer mentioned aggressive collection practices, stating that missing a payment resulted in constant harassment from the lender .

• A review on Trustpilot reflected a common concern about hidden fees: “I was blindsided by hidden fees that drove up the cost of my loan” .

These testimonials provide valuable insights for potential borrowers considering eLoanWarehouse.

Comparative Analysis

To help potential borrowers make informed decisions, here’s a detailed comparison between eLoanWarehouse and other lending options:

| Feature | eLoanWarehouse | Earnin | Local Credit Union |

| Interest Rates | 400% – 700% APR | 0% – Low optional tips | Typically lower rates |

| Hidden Fees | Numerous | Transparent | Usually none |

| Approval Process | Fast but potentially misleading | Fast and clear | Varies, often longer |

| Repayment Terms | Rigid, short-term | Flexible | More options available |

This table highlights critical differences that can influence a borrower’s choice.

Financial Education

Tips for Responsible Borrowing

• Set a Strict Budget: Before taking out a payday loan, calculate how much you can afford to repay without jeopardizing your financial stability.

• Read All Terms Carefully: Ensure you understand all fees and interest rates associated with the loan.

• Explore Counseling: If you’re unsure about your ability to repay or if you’re facing financial difficulties, consider consulting with a financial advisor.

Regulatory Information

State Regulations

Payday loan regulations vary significantly by state. Some states impose strict limits on interest rates and borrowing amounts to protect consumers from predatory lending practices. Understanding your state’s laws can empower you to make informed decisions about borrowing.

Alternatives to Consider

Innovative Lending Solutions

Explore newer platforms or community-based lending options that prioritize fair practices:

• Peer-to-Peer Lending Platforms: These platforms connect borrowers directly with individual lenders who may offer lower interest rates.

• Local Community Programs: Some nonprofits offer no-interest loans for emergencies, providing a more sustainable alternative to payday loans.

Conclusion

While eLoanWarehouse offers a convenient solution for immediate financial needs, the potential pitfalls—such as exorbitant interest rates and hidden fees—make it crucial for borrowers to proceed with caution. Always explore alternative options that prioritize your financial well-being over quick access to cash. Remember, the best loan is one that resolves your immediate needs without creating long-term financial issues.

If you’re struggling with payday loan debt, consider reaching out to a financial advisor or a credit counseling service for assistance. They can help you create a repayment plan or explore consolidation options.

FAQs Section

What are the eligibility criteria ?

To qualify for a payday loan from eLoanWarehouse, you typically need to be at least 18 years old, have a steady source of income, and provide valid identification.

How does eLoanWarehouse handle late payments?

If you miss a payment, eLoanWarehouse may charge late fees and could potentially report the delinquency to credit bureaus. It’s essential to contact them immediately if you’re unable to make a payment.

Can I apply for a payday loan if I have bad credit?

Yes, eLoanWarehouse primarily uses soft credit checks, which means that having bad credit may not disqualify you from obtaining a loan. However, higher interest rates may apply.

What should I do if I feel overwhelmed by my payday loan debt?

If you’re struggling with payday loan debt, consider reaching out to a financial advisor or a credit counseling service for assistance. They can help you create a repayment plan or explore consolidation options.

You can read also

Halo (2003) Game Icons Banners – A Deep Dive into Their Artistic Legacy